Some Ghanaians have expressed cautious relief as the local cedi currency continues to appreciate against major world trading currencies.

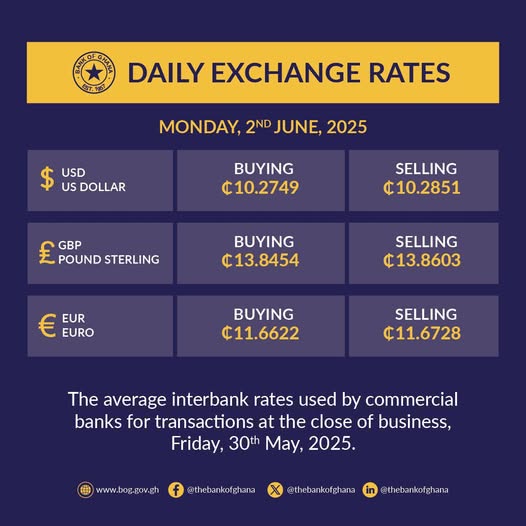

On Wednesday, the currency sold between 10.29 cedis and 10.30 cedis against the dollar, compared with 15.3 cedis to the dollar at the beginning of 2025, according to the Bank of Ghana.

“There are many benefits in having a stronger currency: We change our currency into dollars to trade with China, Dubai, and other countries. But with this trend, we will need fewer cedis to transact business,” Lord Appiah-Dankwa, a traders association leader in Accra, the Ghanaian capital, said in an interview on Tuesday 27th May.

Appiah-Dankwa added that the turnaround of the value of the local currency would result in some savings for businesses and individuals since the prices of imported items would also begin to trend downwards.

“Prices of goods on the markets are not stable because people with new stocks are trying to reduce their prices, but those with old stocks are counting their losses, but with time, market forces will force prices down gradually,” he projected.

Moreover, he said prices of petroleum products were also falling due to the appreciation of the local currency.

The only problem I foresee in the short term is that people with old stocks would make some losses when new goods purchased under the lower exchange rates begin to arrive, said the trader.

What we need going forward is stability and sustainability in the exchange rate. We cannot forecast now because of the instability, said Appiah-Dankwa.

Stephen Deegbe, a student of the University of Media Art and Communications (UniMAC), lauded the government for reversing the depreciation of the local currency, bringing relief to Ghanaians.

“Many Ghanaians recall the past when the exchange rate reached about 17 cedis to the dollar, with things getting out of hand,” Deegbe stated.

According to the UniMAC student, one concern many have expressed is about sustainability, which government officials have responded to with firm assurances.

Bank of Ghana Governor Johnson Asiama attributed the rallying cedi to a combination of factors, including a tight monetary policy stance, ongoing fiscal consolidation, record reserve accumulation, strict enforcement of foreign exchange market rules, and improved market sentiment.

Asiama told the media last Friday that Ghana’s reserves had reached 10.1 billion dollars, a relatively comfortable reserve position, helping to ease the pressure in the foreign exchange market.

“In the year to May 21, 2025, the cedi had appreciated against all the major currencies: 24.1 percent against the US dollar, 16.2 percent against the British pound, and 14.1 percent against the euro,” Asiama stated.

He said the stronger local currency had also contributed to a 2.6 percentage point decline in inflation over the first four months of the year.

Asiama said the next phase of the central bank’s reforms would focus on sustaining foreign exchange inflows and strengthening foreign exchange market regulatory oversight to sustain the current gains.

Ghanaian President John Dramani Mahama indicated that the recovery in the value of the cedi has culminated in the reduction of the country’s debt burden.

Speaking at the just ended annual meetings of the African Development Bank in Abidjan, the capital of Cote d’Ivoire, Mahama said the value of the local currency was one of the push factors for the country’s growing debt.

“Fortunately, we have put in place some measures that are strengthening the cedi, and so we have reduced our debt by about 150 billion cedis over the past five months,” the president said.

“If the trajectory continues, the target of improving debt sustainability by reducing total public debt to GDP ratio to below 55 percent by the end of this year instead of 2028,” he added.

Since taking power in January, the Mahama-led government has introduced measures including spending cuts, tax rationalization, and stronger regulation of gold trade to ensure control of public debt and maximize foreign exchange accumulation.